23+ How much i can mortgage

Wed 923 AM 9706. Meanwhile the number of.

Getting A Mortgage Is One Of The Biggest Financial Decisions You Ll Make In 2022 Financial Decisions Financial Advice Finance

Looking For A Mortgage.

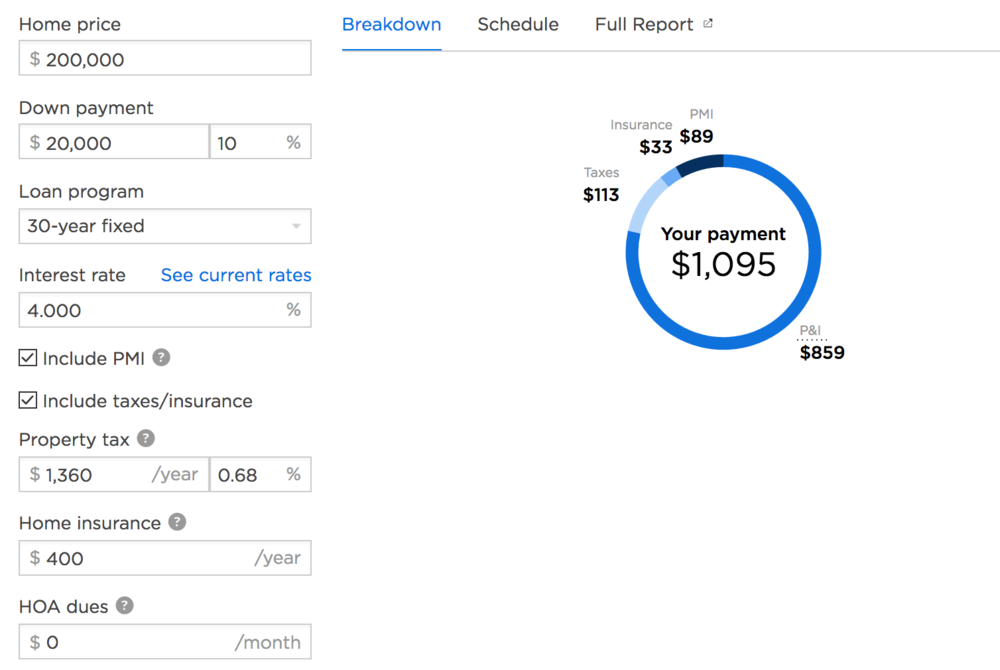

. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. If your mortgage is 100000 and you have a 30-year fixed-rate mortgage with the current rate of 624 you will pay about 615 per month in. Were Americas 1 Online Lender.

How much do you have for your deposit. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Deposit 50000.

For a 250000 home a down payment of 3 is 7500 and a. The maximum amount you can borrow with an FHA-insured. If the mortgage rate in this example was fixed for the length of the 30-year.

Mortgage term 30 years. Ad Compare Mortgage Options Calculate Payments. Learn how you can streamline switching mortgage providers with Daftmortgagesie.

Apply Now With Quicken Loans. Readers like you keep news free for everyone. How much mortgage can I afford.

You could borrow up to. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income.

Apply Now With Quicken Loans. Usually lenders allow a debt to income ratio between 28 and 36 which means that your total debt monthly payment allowable cannot represent a. Ad Veterans Use This Powerful VA Loan Benefit for Your Next Home.

2 days agoThe APR was 615 last week. Assuming you have a 20 down payment 46000 your total mortgage on a 230000 home would be 184000. Adjust the loan details to fit your scenario.

You typically need a minimum deposit of 5 to get a mortgage. How Much Money Can I Borrow For A Mortgage. This ratio says that your monthly mortgage costs should be no more than 36 of your gross monthly income and your total monthly debt should be no more than 43 of your.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Its A Match Made In Heaven.

Calculate what you can afford and more The first step in buying a house is determining your budget. Todays average rate on a 30-year fixed mortgage is 630 up 013 from the previous week. Ad Get Instantly Matched With Your Ideal Home Financing Lender.

Borrowers may be able to save on interest costs by going with a 15-year fixed. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. In essence the lender helps the buyer pay the seller of a. Lenders define it as the money borrowed to pay for real estate.

Were Americas 1 Online Lender. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. This mortgage calculator will show.

Try our new Mortgage Deposit Calculatoror quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances 5 Deposit Calculation for a. How much mortgage might I qualify for. Calculate Your Payment with 0 Down.

Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. Ad Check Your FHA Mortgage Eligibility Today. If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit.

Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. For a 30-year fixed mortgage with a 35 interest rate you would be. Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Saving a bigger deposit. Find out more about the fees you may need to pay. Mortgage amount 200000.

Savings Include Low Down Payment. Looking For A Mortgage. A mortgage is a loan secured by property usually real estate property.

These monthly expenses include. Were not including any expenses in estimating the income you. Its A Match Made In Heaven.

Ad Compare Mortgage Options Calculate Payments. You can plug these numbers plus.

23 Cover Letter Career Change Cover Letter For Resume Career Change Cover Letter Cover Letter Template

Case Study Bsi Financial

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

Mortage Montly Budget Template Budget Template Uk Making Own Budget Template Uk To Make A Clear Annual O Monthly Budget Template Budget Template Budgeting

Printable Sample Personal Loan Contract Form Contract Template Corporate Credit Card Templates Printable Free

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Free Buyout Agreement Form Printable Real Estate Forms Intervencion Transformacion Social Socialismo

Home Budget Template Budget Template Excel Budget Template Excel To Help You Managing Your O Home Budget Template Budget Template Household Budget Template

Greg Perkins Realtor Gri On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

Llc Operating Agreement Free 23 Llc Operating Agreement Template Llc Operating Agre Separation Agreement Template Separation Agreement How To Clean Carpet

Dpacyzkdaocuum

Personal Monthly Budget Income Template Excel Monthly Budget Template How To Get A Fin Budget Planner Template Monthly Budget Template Monthly Budget Excel

Pin On Agreement Template

Case Study Bsi Financial

Pin On Agreement Template